And we owe it all to my 401(k), baby! I’ve hinted at some problems with it in the past – we were waiting for it to show correctly in our accounts (long story) – but the good day has came and we’re back on track! A whopping $30k on track.

I know I’ve harped on it before, but it just goes to show that consistent saving & investing DOES ADD UP over time. And hopefully you’ll be able to watch it grow every month instead of getting a huge sorta-but-not-really surprise in your account one day ;) The point is, you have to start TODAY – not tomorrow, not next month or next year, but today. Start small if you have to, whatever it takes. And while I recommend the 401(k) for all that free money your company hopefully matches you on, it’s certainly not necessary. An IRA or savings account would work just as nicely.

So yeah, the 401(k) stuff is the biggest change this month, with a major decrease in cash reserves being second. I’ll explain more below, but this was also connected to the 401(k) stuff – and something I consciously decided to do. Only $5k more to hit that $100k mark! Woohoo!

Here’s how June’s net worth breaks down:

CASH SAVINGS (-$3,586.80): For the last two paychecks I’ve been contributing 90% of my paycheck to that same 401(k) so I can make up for some lost time. In doing that, I literally only get $69 and change per check now! Ouch. Thus, I’ve been dipping into my $5k+ side savings account to make up the difference each period to continue paying all bills & to stay “on budget“. As you can imagine, this will only last another check or so before I run out ;) But if YOUR company matched 100% of 100% you put in up to the yearly maximum allowed, wouldn’t you find a way to make it happen? It’s all about taking advantage of the perks given to you and finding a way to make it work.

EMERGENCY FUND ($0.00): Our $10k is still sleeping away nicely in our Money Market account. It’s mixed in with other funds so I can’t determine exactly how much interest is accruing on the Emergency Fund in particular, but it’s definitely adding up.

ROTH IRAs (+$358.32): The good thing here is that I was able to scrounge up a decent $550 to put into the pot this month! The downside was that the markets already sucked out $200 of it. But like everything else tied to this roller coaster economy, it has its ups and its downs. But Operation Buffett is still in effect…

401(k)s (+$30,304.58): Is there anything more to say about this? ;) I was contributing a butt load. It wasn’t showing up properly. But now it is. Actually, there’s a little more to it than that but I can’t really talk about it here. But no, mr. punch debt in the face, I was not funding a crack house on the side – you silly goose, you.

SAVINGS BONDS (+$0.20): Oh Joy! This will actually be the last time you see this category here though, so wave it goodbye (byyyyeeee). I finally listened to Ishan’s advice to unload the bonds and invest the money elsewhere. You’ll hear about it soon as I didn’t have the time to incorporate it all here.

AUTOS WORTH (kbb) (-$375.00): A little more than the $50 devaluation from last month, but whatever – no one ever said cars were an investment ;) Here’s how they line up this month:

- Pimp Daddy Caddy: $3,495. Down the $50 buckaroos.

- Gas Ticklin’ Toyota: $10,185. Booooo.

HOME VALUE (Realtor) ($0.00): This will remain @ $300k (the price our realtor set it at) until I hit him up again later for another review. He’s the master in our particular neighborhood, and has been selling (and living in) in this area for 20+ years. I keep an eye on Zillow & Redfin.com on the side too to see what else is happening out there. Zillow just fluctuates so much, it’s crazy. I love the site, but it’s seriously nuts.

CREDIT CARD (car loans) ($0.00): Still at Zero! The previous debt here was an “auto loan” that I happened to charge on my credit card – effectively setting my interest @ 3%. I don’t recommend this for everyone, but the method works well if you know what you’re doing and don’t have outstanding debt lined up. I’ll leave this category in until I’m tired of looking at it ;)

MORTGAGES (-$386.01): We’re still eager to refinance our first mortgage, but unfortunately we’re still too under water to get on it. So in the meantime we chip away with any extra money we have left from our “house budget”. Here’s how they breakdown:

- Mortgage #1: $287,235.91 – 30 year fixed, interest-only @ 6.875%.

- Mortgage #2: $62,808.73 – Maxed out HELOC w/ 2.8% interest.

Well, that’s it for this month. How’d you all do? Anyone win the lottery or take on a major mortgage? Whatever the case, remember to judge your success off of YOUR goals only. I know it’s hard sometimes, but it’s really the only thing you have control of. So if you’re meeting or exceeding your goals, you’re on the right track!

God Bless,

—————–

*My budget has now been updated.

*And so have my sidebars.

PS: If you’re just getting started in your journey, here are a few good resources to help track your money. Doesn’t matter which route you go, just that it ends up sticking!

- The "Budget/Net Worth" spreadsheet - the colorful Excel template I personally use.

- The "Money Snapshot" spreadsheet - a simple Excel template I created for my former $$$ clients

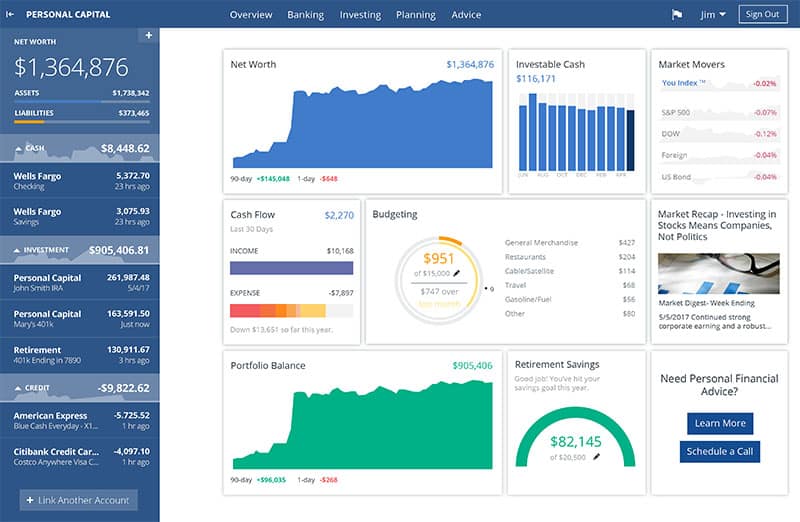

If you're not a spreadsheet guy like me and prefer something more automated (which is fine, whatever gets you to take action!), you can try your hand with a free Empower account instead (formerly Personal Capital)

Empower is a cool tool that connects with your bank & investment accounts to give you an automated way to track your net worth. You'll get a crystal clear picture of how your spending and investments affect your financial goals (early retirement?), and it's super easy to use.

It only takes a couple minutes to set up and you can grab your free account here. They also do a lot of other cool stuff as well which my early retired friend Justin covers in our full review of Empower - check it out here: Why I Use Empower Almost Every Single Day.

Get blog posts automatically emailed to you!